At RE+ 2024, it’ll be tough to find sessions that don’t mention the Inflation Reduction Act. This cornerstone policy is reshaping the U.S. clean energy landscape – and this year, the industry is finally gaining clarity on some of its crucial aspects. The IRS has recently rolled out comprehensive guidance and finalized rules for several of the IRA’s renewable energy tax incentives, helping unlock its full potential to accelerate the expansion of clean energy markets.

Explore essential updates to the Inflation Reduction Act regarding clean energy, along with RE+ sessions in Anaheim that will examine their impact on clean energy business strategies and operations:

Key 2024 Inflation Reduction Act Updates

While the IRA has already helped accelerate clean energy adoption across the nation, the implications of several key provisions remained ambiguous as developers awaited further guidance and final rules for their application. This year we’ve seen much-needed clarity for those provisions. For instance, in 2024 the IRS issue final guidance for the IRA’s prevailing wage and apprenticeship requirements and its powerful tax credit transferability mechanism, which broadens clean energy tax credit eligibility and expands the supply of available financing. The IRS has also released qualifications for energy community tax credits and guidance for the IRA’s domestic content bonus credit, which expands its applicability for both hydropower and solar equipment. These updates have helped unlock new financing sources and mechanisms across the clean energy industry. For a comprehensive overview of their impact on solar energy, check out the latest and most significant IRA developments in the RE+ session IRA+: What’s New in the IRA Era.

Guidance for IRA Tax Credits

Until now, clean energy facilities have struggled through a complicated application process and tax code to take advantage of applicable tax credits – especially the IRS Section 45 production and Section 48 investment tax credits. One of the IRA’s most significant clean energy achievements was the replacement of these barrier-laden, restricted credits with streamlined, expanded IRA 48E and 45Y tax credits by 2025. This year, the U.S. Treasury and IRS issued both proposed guidance for these tax credits, and final guidance for two powerful IRA clean energy tax credit mechanisms: transferability and elective (or direct) pay. The transferability mechanism allows stakeholders to receive tax benefits without direct project ownership, incentivizing many corporations and tax-exempt entities to benefit from clean energy tax credits that were previously unavailable to them. Meanwhile, the elective pay mechanism makes several tax credits available to local governments for the first time. These mechanisms, combined with the IRA’s expanded tax credits, are significantly increasing access to the renewable energy market for many stakeholders. While some aspects of the tax credit application process may have been streamlined, navigating it continues to challenge clean energy project developers and stakeholders. At RE+, financial and clean energy policy experts provide an in-depth guide to leveraging these new IRA credits and mechanisms at Tax Equity and Transferability: Pathways to Accelerate the Clean Energy Transition.

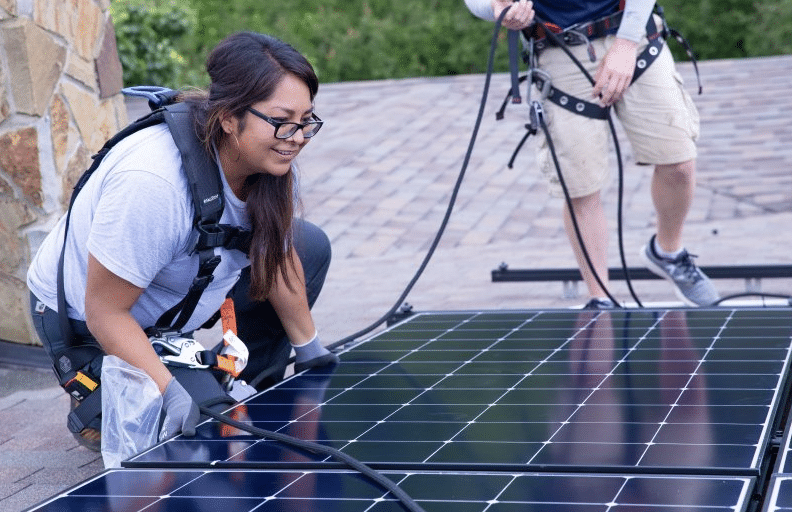

Growing a Stronger Workforce

The IRA has already helped create over 100,000 jobs in clean energy manufacturing alone, while finding skilled labor has long been a challenge in the fast-growing industry. Projects may attract workers and qualify for a substantial increase in tax credits—potentially up to five times the base amount — by complying with the IRA’s clean energy apprenticeship and wage requirements finalized this year.

Attendees of RE+ will find multiple options for learning about the IRA’s labor requirements and their industry impact. SEIA/SEPA’s workshop Navigating the Inflation Reduction Act’s Labor Provisions in the Final Regulations provides a deep dive for those seeking to achieve compliance and maximize their tax credit eligibility. For a more general approach to solar labor development, Emerging Trends in Apprenticeship offers insights from experts on best practices in apprenticeships, recruiting, retention, education, funding, and community partnerships.

Unpack the IRA’s Transformative Impact at RE+

Armed with this year’s IRA updates, RE+ discussions – including deploying IRA for diverse communities and case studies of IRA-compliant domestic manufacturing – will provide more actionable insights on the IRA’s benefits than ever before. The recent clarifications and expansions in tax incentives, particularly around the streamlined 48E and 45Y credits, are shaping a robust framework for sustainable growth and innovation in clean energy. We look forward to engaging with many of you at the event, sharing insights, and exploring how we can accelerate clean energy adoption across the nation. To set up a time to talk at the show, or connect after the hullabaloo, contact us.